rhode island income tax rate 2020

Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Individual Income Tax Structures In Selected States The Civic Federation

Detailed Rhode Island state income tax.

. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in late December of their individual tax rate. Tax rate of 375 on the first 68200 of taxable income. DO NOT use to figure your Rhode Island tax.

Of the on amount Over But Not Over. The current tax forms and tables should be consulted for the current rate. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

Tax rate of 375 on the first 68200 of taxable income. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. The Rhode Island tax is based on federal adjusted gross income subject to modification.

The income tax is progressive tax with rates ranging from 375 up to 599. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Missouri for single. Find your gross income.

The rate so set will be in effect for the calendar year 2019. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island.

Tax rate of 475 on taxable income between 68201 and 155050. You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06. Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly.

Find your pretax deductions including 401K flexible account contributions. Levels of taxable income. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Rhode Island Tax Brackets for Tax Year 2020. Find your income exemptions. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Interest on overpayments for the calendar year 2020 shall be at the rate of five percent 500 per annum.

The rate for new employers will be 116 percent including the 021 percent Job Development Assessment. For married taxpayers living and working in the state of Rhode Island. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI. Rhode Island Income Tax Rate 2020 - 2021 Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket.

Taxable Wage Base. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Find Rhode Island income tax forms tax brackets and rates by tax year.

The rate so set will be in effect for the calendar year 2020. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly.

2022 New Employer Rate. Tax Rate 0. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

Tax rate of 599 on taxable income over 155050.

Individual Income Tax Structures In Selected States The Civic Federation

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

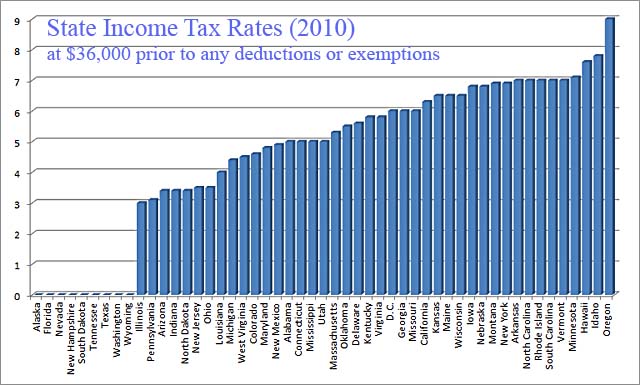

State Income Tax Rates Highest Lowest 2021 Changes

Washington S Combined State Local Sales Tax Rate Ranks 5th In The Nation Opportunity Washington

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Rhode Island Income Tax Brackets 2020

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Low Tax States Are Often High Tax For The Poor Itep

Monday Map Top State Income Tax Rates Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Massachusetts Income Tax Rate And Brackets 2019

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)